What are the three basics of money laundering?

Money laundering, the art of making dirty money sparkle like it just came out of a washing machine—except the detergent is deceit and the rinse cycle involves a few offshore accounts. But seriously, if you’re curious about how this financial wizardry works, here’s a crash course in the three key steps. Just remember, this is purely educational—don’t go trying to launder your aunt’s bingo winnings.

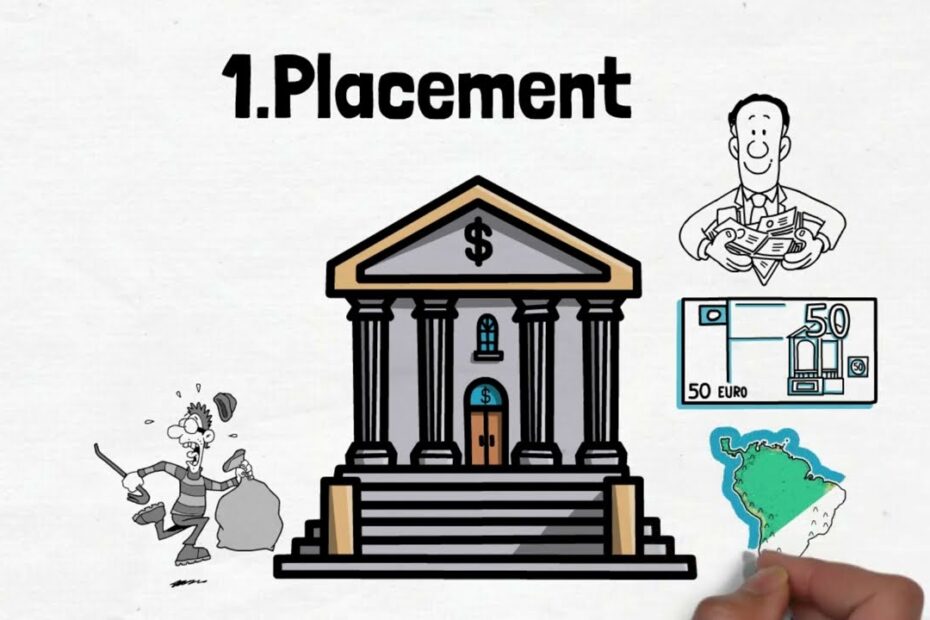

1. Placement: The Initial Drop

Placement is like the first step in a game of hide and seek, except instead of your cousin Timmy, it’s a briefcase full of cash. This is where the “dirty” money enters the financial system. Imagine someone walking into a bank with a duffle bag full of cash and saying, “Oh, totally legitimate business funds. Nope, nothing to see here.” The goal is to get the money into the system without raising eyebrows, which is why it’s often done in small amounts or through cash-intensive businesses—like that one friend who always seems to have a new gadget but works at a part-time gig.

2. Layering: The Money Maze

Layering is where things get fancy, like a magic trick where the money disappears and reappears looking squeaky clean. This step involves moving the money around through various transactions—think wire transfers, shell companies, or even buying and selling assets. It’s like playing a game of financial hopscotch, where each jump is designed to confuse anyone trying to trace the money’s origin. Imagine sending the cash on a world tour—Switzerland, the Cayman Islands, maybe a quick stop in Panama—before it finally comes back home looking like a model citizen.

3. Integration: The Clean Finish

Integration is the final act, where the now-squeaky-clean money is mixed back into the legitimate economy. It’s like adding a splash of clean water to muddy it up—except in reverse. The money might be invested in real estate, stocks, or even a fancy car that’s totally necessary for “business purposes.” By this point, the money has a fresh new backstory, and no one suspects a thing. It’s like baking a cake where the secret ingredient is a dash of “I’m definitely not a criminal.”

And there you have it—the three basics of money laundering. Just remember, this is all hypothetical, and you should definitely not try this at home. Or anywhere else. Seriously, don’t.

What are the three steps of laundering?

What Are the Three Steps of Laundering?

Laundering, the art of making dirty money sparkle like new, involves three key steps that are as intricate as a bad spy novel plot. Let’s break them down with a dash of humor because, let’s face it, who doesn’t love a good laundry day?

Step 1: Placement – The Initial Spin Cycle

Imagine you’ve got a wad of cash that’s hotter than a freshly laundered sock. Placement is where you toss this money into the financial system like it’s a salad spinner. You might open a few bank accounts, invest in some shady startups, or even buy a llama farm (because who wouldn’t want a llama farm?). The goal? To make it look like your money’s doing something legitimate, even if it’s just sitting there looking pretty.

Step 2: Layering – The Shell Game

Now, layering is where things get as complicated as a cake with too many layers. You move the money around, maybe through offshore accounts or shell companies, each transaction making it harder to trace. It’s like playing a game of financial hide-and-seek, where each layer is a new disguise. Think of it as a pinball machine – the money bounces around so much, even you might lose track!

Step 3: Integration – The Final Rinse

Integration is where you blend the now-squeaky-clean money back into the economy. It’s like when a secret agent tries to live a normal life but ends up buying a house with a moat. You might invest in real estate, start a business, or buy something flashy. The goal? To make it all look perfectly normal, even if it’s as over-the-top as a neon sign blinking “Clean Money Here!”

So there you have it – the three steps of laundering, where dirty money gets a makeover, all while keeping things light and laughable. Because who doesn’t love a good spin cycle?

What are the three strategies of money laundering?

1. The “Oops, I Found This Cash in My Couch” Strategy (Placement)

Ah, placement—the art of making dirty money look like it fell out of your pocket during a particularly aggressive nap. This is where criminals try to sneak illicit funds into the legitimate financial system. Think of it like trying to discreetly add a live octopus to a community swimming pool. Classic methods include:

- Buying a suspicious number of gift cards “for your nephew’s birthday.”

- “Investing” in a cash-heavy business, like a llama grooming salon or a kombucha stand that only accepts $100 bills.

- Smuggling cash in hollowed-out cabbages (a surprisingly popular vegetable in money-laundering lore).

The goal? Make the money look like it came from a source less questionable than, say, a back-alley diamond heist.

2. The Financial Shell Game (Layering)

Next up: layering, the money launderer’s version of playing hide-and-seek with a GPS tracker. This involves shuffling funds through so many accounts, currencies, and offshore shell companies that even the money gets lost and asks for directions. Imagine a squirrel on espresso hiding acorns in 17 different forests. Techniques include:

- Wire transfers between countries you can’t find on a map.

- Buying and selling cryptocurrency, NFTs, or “rare” Beanie Babies to create a paper trail longer than a CVS receipt.

- Creating fake invoices for “consulting services” rendered by a firm named *Definitely Not Crime Inc.*

The more convoluted the path, the better—preferably involving at least one volcano lair.

3. The “Totally Legit Business” Charade (Integration)

Finally, integration—where dirty money emerges from its spa day, wrapped in a fluffy towel of legitimacy. Now it’s ready to buy a yacht named *Innocent Bystander*. This phase involves funneling the “cleaned” cash back into the economy through seemingly above-board ventures, like:

- A trendy art gallery selling abstract paintings of existential dread (priced at $1 million each).

- A chain of mattress stores that never have customers but somehow post record profits.

- A viral TikTok brand hawking glow-in-the-dark toilet paper.

The key is to make the money look earned, even if the business’s only employee is a golden retriever named CFO.

Remember, kids: Money laundering turns “ill-gotten gains” into “taxable income,” which is arguably *almost* as criminal.

What does integration mean in money laundering?

Imagine you’ve spent weeks sneaking spinach into a toddler’s smoothie—only to finally serve it in a “100% organic, definitely-not-green” sippy cup. That’s integration in money laundering: the art of making dirty cash look so legit, even a forensic accountant might shrug and say, “Seems chill.” It’s the final stage where illicit funds get a glow-up, blending into the financial system like a undercover avocado at a guacamole party.

Step 1: The Money Spa Day

After placement (hiding the cash) and layering (confusing the paper trail), integration is where the money gets its “clean persona”. Think shell companies suddenly “earning” profits from selling artisanal air, or a cash-heavy pizza joint reporting 10,000 extra pepperoni sales. The goal? Turn “questionable” into “quarterly earnings report” faster than you can say, “Wait, since when do bakeries need offshore accounts?”

Step 2: The Shell Game, But Make It Boring

- Fake employees: Phantom staff who “earn” salaries (direct deposits included, because professionalism).

- Real estate romance: Buying property with laundered cash, then selling it to yourself… but fancier.

- “Consulting fees”: The financial equivalent of whispering “trust me bro” into a spreadsheet.

Integration thrives on boring paperwork and unimpeachable boredom. The more mundane the transaction, the less likely anyone will notice the $2 million “revenue” from your cousin’s basement-based sock puppet LLC. It’s like hiding a disco ball in a library—just slap some Dewey Decimal stickers on it, and suddenly, it’s “research infrastructure.”

In the end, integration is the money launderer’s mic drop. The moment dirty cash becomes a “small business loan” or a “stock portfolio,” complete with receipts as real as a unicorn’s grocery list. And voilà! Crime pays… as long as it’s filed under “tax-deductible.”