In Cuba, the local currency is the Cuban peso (CUP). It comes in different denominations, including 50s, 20s, 10s, 500s, 200s, and 1,000s. However, there is also another currency called the MLC (Moneda Libremente Convertible) or MLSA (Moneda Libremente Convertible en Sucursales Bancarias).

The MLSA is equivalent to the US dollar and is primarily used by Cubans to access certain goods, such as food and other products, at specific stores. To obtain the MLSA currency, Cubans must go to the bank and deposit high-value currencies like Euros, USD, or pounds. This allows them to access MLSA for their purchases.

It’s important to note that foreigners can use MLSA for their transactions, but if you’re visiting from the United States, you won’t be able to use American cards at ATMs or MLSA stores in Cuba.

There are restrictions on foreign currency usage in Cuba. The country has undergone significant changes in its currency system in recent years, and as a result, travelers often wonder where to exchange their money and which currency is better to bring, such as USD or Euros.

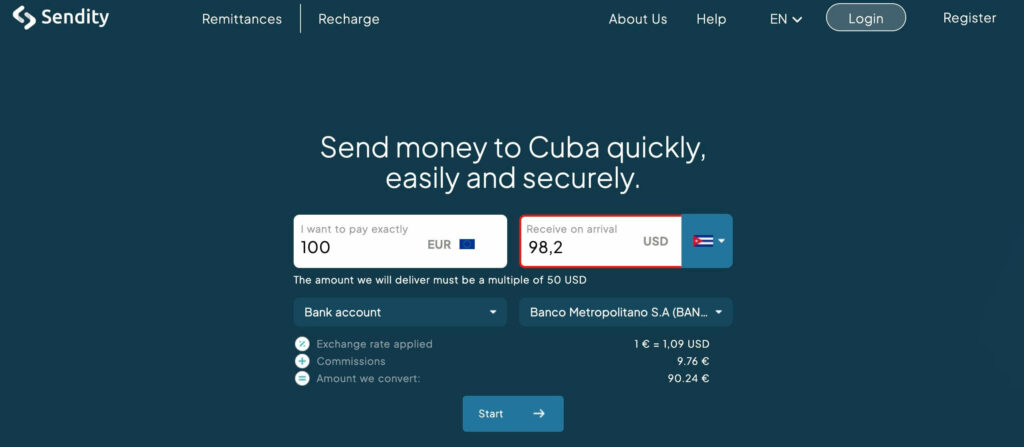

You can even send money to Cuba very fast here

It’s recommended to bring Euros, USD, or pounds when traveling to Cuba, as they can be exchanged for Cuban pesos. However, determining exactly how much money you will need is challenging, so it’s advisable to exchange a moderate amount initially and then adjust as needed.

When exchanging money, it’s best to avoid exchanging at the airport, as the exchange rate is typically less favorable. Instead, consider exchanging with trusted sources like private drivers, local guides, or your Airbnb host. They can offer better rates and help ensure you don’t receive counterfeit bills.

Additionally, it’s wise to bring small denomination bills, such as 20s, 50s, 10s, and 5s, as they are more convenient for tipping and making smaller purchases. It’s also essential to have newer bills without any marks or damage, as some places may refuse ripped or defaced currency.

The devaluation of the Cuban peso has been influenced by various factors, including sanctions by the Trump Administration, mismanagement by the Cuban government, the impact of the COVID-19 pandemic, and limited economic opportunities. As a result, locals often pay more pesos for dollars, and the cost of goods has significantly increased.

Overall, when visiting Cuba, it’s crucial to plan and research carefully, knowing where to exchange money in cuba, how much to bring, and being prepared with sufficient cash, as credit cards may not be widely accepted. By being informed and prepared, you can navigate the Cuban currency system effectively and make the most of your trip.

Table of Contents

- Exchanging Money in Cuba

- Determining the Amount of Money Needed

- Tips for Handling Cash in Cuba

- Reasons for Peso Devaluation in Cuba

- Challenges of Peso Devaluation

- Understanding currency and money exchange in Cuba

- FAQ

Exchanging Money in Cuba

When visiting Cuba, one of the most common questions travelers have is how and where to exchange money. Here are some key points to keep in mind:

Frequently asked questions about exchanging money

Many travelers wonder how much money they will need for their trip to Cuba. It is difficult to estimate an exact amount, so it is recommended to exchange a moderate amount initially and then adjust as needed. Additionally, it is advisable to bring small denomination bills, such as 20s, 50s, 10s, and 5s, as they are more convenient for tipping and making smaller purchases.

Comparison between USD and Euros

When deciding which currency to bring, it is generally recommended to bring Euros, USD, or pounds, as they can be exchanged for Cuban pesos. However, it is important to note that the exchange rate for Euros is often more favorable than for USD. Therefore, if you have the option, consider bringing Euros to get a better value for your money.

Recommendations on where to exchange money

It is best to avoid exchanging money at the airport, as the exchange rate is typically less favorable. Instead, consider exchanging with trusted sources such as private drivers, local guides, or your Airbnb host. They can offer better rates and help ensure you don’t receive counterfeit bills.

Caution against exchanging money at the airport

Exchanging money at the airport is not recommended due to the less favorable exchange rate. By avoiding airport exchanges, you can get a better value for your money and avoid potential counterfeit bills.

Explanation of current exchange rate

As of January 5, 2024, the exchange rate on the streets of Cuba is approximately 265 pesos for 1 USD. However, if you were to exchange money at the airport, the rate would be around 120 pesos for 1 USD. It is important to be aware of the current exchange rate and choose the most advantageous option for exchanging your money.

By following these recommendations and being informed about the currency exchange process in Cuba, you can ensure that you make the most of your trip and have a smooth financial experience during your stay.

Determining the Amount of Money Needed

Estimating the required amount of money for your trip to Cuba can be difficult. However, there are some tips to help you plan your finances effectively:

- Exchange a moderate amount initially: Since it’s challenging to determine the exact amount of money you will need, it’s advisable to exchange a moderate amount of currency initially. This way, you can adjust your expenses based on your actual needs.

- Exchange smaller amounts: Rather than exchanging all your money at once, consider exchanging smaller amounts periodically. This approach allows you to manage your budget more effectively and reduces the risk of carrying large sums of cash.

- No exchanging back to original currency: Keep in mind that you cannot exchange Cuban pesos back to your original currency. Therefore, it’s crucial to plan your currency exchange carefully to avoid ending up with excessive pesos at the end of your trip.

- Research and plan accordingly: To ensure you have enough money for your trip, it’s essential to research and plan in advance. Consider factors such as accommodation, transportation, meals, activities, and souvenirs. This way, you can estimate a reasonable budget and exchange the appropriate amount of currency.

When exchanging money, it’s best to avoid exchanging at the airport, as the exchange rate is typically less favorable. Instead, consider exchanging with trusted sources like private drivers, local guides, or your Airbnb host. They can offer better rates and help ensure you don’t receive counterfeit bills.

By following these recommendations and being prepared, you can ensure that you have sufficient funds to enjoy your trip to Cuba without any financial stress. Remember to plan ahead, exchange wisely, and enjoy your time exploring the vibrant culture and beautiful landscapes of Cuba!

Tips for Handling Cash in Cuba

When traveling to Cuba, it’s important to understand the local currency system and how to handle cash effectively. Here are some tips to keep in mind:

Importance of cash over credit cards

In Cuba, cash is king. Credit cards may not be widely accepted, so it’s crucial to have sufficient cash to cover your expenses. This includes accommodations, transportation, meals, activities, and souvenirs.

ATM restrictions for foreign credit cards

If you’re visiting from the United States, be aware that American cards may not work at ATMs or MLC stores in Cuba. It’s essential to plan accordingly and bring enough cash to avoid any inconvenience.

Advice to bring sufficient cash for planned activities

To ensure a smooth trip, it’s recommended to bring an appropriate amount of cash based on your planned activities. Research and estimate the costs of attractions, dining, and transportation to determine how much cash you’ll need.

Suggestion to carry small denomination bills

When exchanging money, it’s wise to carry small denomination bills such as 20s, 50s, 10s, and 5s. These bills are more convenient for tipping and making smaller purchases during your stay in Cuba.

Recommendation to have newer bills without marks or damage

When exchanging currency, ensure that your bills are new and without any marks or damage. Some places may refuse ripped or defaced currency, so having clean bills will avoid any issues during your transactions.

Reasons for Peso Devaluation in Cuba

The devaluation of the Cuban peso has been influenced by various factors:

Impact of sanctions by the Trump Administration

The imposition of sanctions by the Trump Administration has had a significant impact on the Cuban economy, leading to the devaluation of the peso. These sanctions have limited economic opportunities, restricted trade, and hindered foreign investment.

Mismanagement by the Cuban government

Mismanagement by the Cuban government has also contributed to the devaluation of the peso. Inefficient economic policies, lack of market reforms, and corruption have hindered economic growth and stability.

Effects of the COVID-19 pandemic

The COVID-19 pandemic has further exacerbated the devaluation of the Cuban peso. Travel restrictions, loss of tourism revenue, and disruptions to global trade have negatively impacted the Cuban economy, leading to a decrease in the value of the peso.

Explanation of why locals pay more pesos for dollars

Locals in Cuba often pay more pesos for dollars due to limited access to foreign currency. The government controls the exchange rate and imposes additional fees and taxes on currency exchanges, resulting in a higher cost for locals to obtain dollars.

Reasons behind Cubans leaving the country

The devaluation of the peso, along with economic hardships, political restrictions, and lack of opportunities, has led many Cubans to leave the country. They seek better economic prospects and freedom in other countries, resulting in a brain drain and further economic challenges for Cuba.

Challenges of Peso Devaluation

The devaluation of the Cuban peso has posed several challenges for the country. Let’s take a closer look at some of the key challenges:

Comparison of past and current prices

Due to the devaluation of the peso, there has been a significant increase in the cost of goods and services. Prices have risen drastically compared to previous years, making it more difficult for Cubans to afford essential items.

Negative impact on the Cuban economy

The devaluation of the peso has had a detrimental effect on the Cuban economy. It has resulted in limited economic opportunities, restricted trade, and hindered foreign investment. This has further hindered the country’s economic growth and stability.

Limited effects on foreigners

Foreigners visiting Cuba may not experience the same challenges as regular Cubans when it comes to the devaluation of the peso. Foreigners can bring hard currency such as Euros or USD, which are not affected by the devaluation. They can also exchange their currency at more favorable rates, allowing them to navigate the Cuban economy with relative ease.

Struggles faced by regular Cubans

Regular Cubans, on the other hand, face significant struggles due to the devaluation of the peso. The increase in prices makes it harder for them to afford basic necessities, leading to financial hardships and a decrease in their overall standard of living.

Shortages in food, medicine, and other necessities

The devaluation of the peso has also contributed to shortages in essential goods such as food, medicine, and other necessities. The increased prices and limited availability of these items make it challenging for regular Cubans to access them, further exacerbating their struggles.

In conclusion, the devaluation of the Cuban peso has had a profound impact on the country and its people. While foreigners may not face the same challenges, regular Cubans are grappling with increased prices, limited access to goods, and economic hardships. It is crucial for the Cuban government to address these challenges and work towards creating a more stable and prosperous economy for its citizens.

Understanding currency and money exchange in Cuba is essential for a smooth trip.

Here are the key points discussed:

- The local currency in Cuba is the Cuban peso (CUP), and there is another currency called the MLC or MLSA.

- Foreigners can use the MLC for transactions, but American cards are not accepted in Cuba.

- It’s recommended to bring Euros, USD, or pounds when traveling to Cuba.

- Exchange money with trusted sources like private drivers, local guides, or your Airbnb host to get better rates and avoid counterfeit bills.

- Bring small denomination bills for tipping and making smaller purchases.

- The devaluation of the Cuban peso is influenced by factors such as sanctions, mismanagement, the COVID-19 pandemic, and limited economic opportunities.

- The devaluation poses challenges for regular Cubans, including increased prices, limited access to goods, and shortages in essentials.

Thank you for your support and engagement. By following these tips and being well-prepared, you can have a successful trip to Cuba and navigate the currency system effectively. Enjoy exploring the vibrant culture and beautiful landscapes of Cuba!

FAQ

Can I use my American cards at ATMs or MLC stores?

No, if you’re visiting from the United States, you won’t be able to use American cards at ATMs or MLC stores in Cuba.

Where is the best place to exchange money?

It’s best to avoid exchanging money at the airport, as the exchange rate is typically less favorable. Instead, consider exchanging with trusted sources like private drivers, local guides, or your Airbnb host.

Should I bring USD or Euros?

It’s recommended to bring Euros, USD, or pounds when traveling to Cuba, as they can be exchanged for Cuban pesos. However, the exchange rate for Euros is often more favorable than for USD.

Can I exchange Pesos back to my original currency?

No, you cannot exchange Cuban pesos back to your original currency. It’s crucial to plan your currency exchange carefully to avoid ending up with excessive pesos at the end of your trip.

Why should I avoid exchanging money at the airport?

Exchanging money at the airport is not recommended due to the less favorable exchange rate. By avoiding airport exchanges, you can get a better value for your money and avoid potential counterfeit bills.